Wheat Flags

Influence on wheat prices

28/04/2020

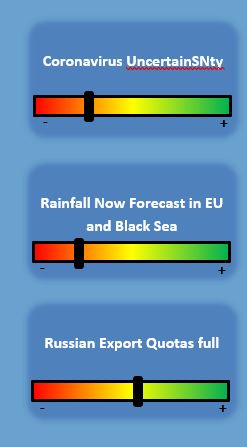

Markets began last week firmer as algorithm-based trading got hold of news reports that Russian traders were getting through the 7Mmt export quota quickly. However, much of this trade is thought to be ‘in house’ with traders booking up export capacity prior to making sales.

Recently ongoing dryness in the EU and Black Sea has also supported prices. However, following a significant change in forecasts later in the week most dry areas are now due to receive rains, and as such the previous buying support has been lost.

It’s a similar story here in the UK, where a lack of rainfall was starting to cause concern. However, as in the EU heavy rains are forecast for most areas which will help to alleviate some of the dryness issues.

Oil markets also continue to add pressure to global economies and markets. Plummeting Crude oil prices have weighed particularly heavily on corn markets. Oil production is likely to be reduced due to the lack of available storage options, which means the demand for ethanol is also likely to fall substantially.

The only bullish potential for markets was that of dryness in the EU and Russia. With the forecast now turning wetter we need another weather story to develop to give prices positive momentum. Otherwise, we are back to trading the virus-related global demand reduction and ample grain supplies around the world.