Urea

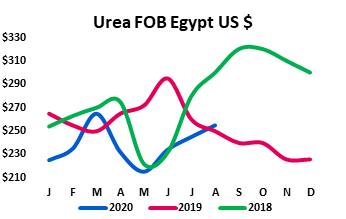

Much to the surprise of the industry, MMTC (Metals and Minerals Trading Corporation of India) only secured 120k tonnes in the tender that closed on 17th July. This despite rumours that over 2M tonnes were offered. So how can that be ? India need tonnes, India were offered tonnes, but did not buy them. Evidently the brinkmanship as discussed here last week, didn’t quite work as MMTC counterbid in an attempt to force prices lower. Producers rejected this approach which has forced another tender just a week after the previous one closed. Bringing this back to a UK perspective as we always aim to do, the source of most of the urea into the UK namely Egyptian Granular Urea firmed by $10 / t last week. The final quarter of the year can quite often see prices reducing as demand globally slows down in this period. Judging by the business that India needs to do, and the reluctance of producers to drop prices, 2020 may buck that trend.

Ammonium Nitrate

Whilst Urea markets have been very bullish with the on-going battle between India and China, UK Ammonium Nitrate markets have lacked direction following the step up in price after the initial new season offers in late May. Signs of a change in the air are apparent as UK producers withdrew terms on Friday 24th. The regular increase in Urea over the recent weeks, compared with the flat A.N market has created the potential of unit value parity, when considering sensible potential volatilisation. To explain, if Granular Urea reaches £ 250/t, then when adding 10% for losses this equates to A.N at just over £ 206/t, this is pretty much where UK AN has been offered at since early July. UK Manufacturers like to work on 24% as an average figure for losses from Urea as this was the conclusion of the DEFRA NT26 report (Nitrogen Fertilising Materials) from 2003. We can then start to get a feel as to where the next pricing point on U.K A.N might be. Granular Urea at £ 250/t, with a loss factor of 20% means A.N at £ 225/t. It seems unlikely given current market activity that they will do this in one step, however we should expect this figure as an aspiration over the next few months. If demand picks up once growers start to get cereal crops in the ground in September and October, then this is a distinct possibility. £ 225 would still be below the low point from the 2019/20 season, covering some tonnes soon could be a sensible move.

Economic Data as at close on Friday 24th July v (17th July 2020) £ = $1.2789 ($ 1.2539) £ = € 1.0996 (€ 1.0971) Crude Oil = $ 43.16 ($ 43.08) Natural Gas = $1.81 ($1.74) Please treat pricing on graphs as a guide, please use quote request form for an up to date price.