Ammonium Nitrate Urea

A better week for drilling in some parts of the country has brought more enquiries forward in the last week or so. The main talking point for the coming week is what will the U.K A.N producers do. There have been no terms since week commencing 21st October. Last week saw the A.I.C (Agriculture Industries Confederation) annual dinner for the fertiliser sector. This would have been a perfect opportunity for manufacturers to sound out the industry and decide on their next move. New terms are expected early next week.

Urea

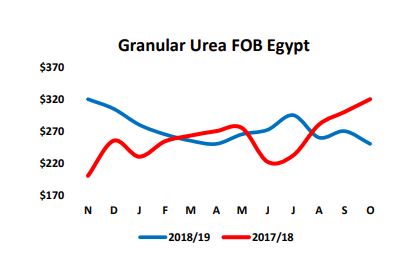

Despite the recent purchase of 1.2M tonnes of Urea by India in the recent MMTC tender, the market continues to be weak. Supply of product in the short term does not appear to be a problem. China returning to the market with this recent Indian tender has played a part in keeping global Urea prices weak. The European market is in a similar position to the UK, delayed purchasing due to poor weather and uncertainty over cropping. In the UK the optimists will point out that most winter wheat varieties can be drilled right up to the end of January which still gives us a full 3 months of opportunity. Even at conservative estimates based on trade written so far the UK could still need to import over 100K tonnes of Urea, with current stock levels this could be quite a challenge as the physical demand in the UK can often start in February.

Another factor in the weakening Urea price on top of the lower global prices has been currency. The key measure in Urea markets is the US Dollar which is the currency that world Urea trades on. From a low of $1.2068 in early September to a high now of $1.2955. This starts to make Granular Urea and also the inhibited products look very attractive. U.K Ammonium Nitrate would come in around the 74 pence per Kg of N level, Granular Urea at around the 58 pence per Kg of N. Even if at that sort of discount Granular Urea still leaves you feeling uneasy, then Limus® at circa 64 pence per Kg N is a serious consideration, no adjustments for volatilisation needed. These are just indications please speak to your Farm Trader for up to date pricing in what is going to be an interesting week.

Economic Data as at close on Friday 1 st November v (25th October 2019) £ = $1.2955 ($ 1.2824) £ = € 1.1608 (€ 1.1560) Crude Oil = $ 60.72 ($ 61.41) Natural Gas = $2.63 ($2.30) Please treat pricing on graphs as a guide, please use quote request form for an up to date price.