Urea

International markets woke up this week with news that India are ready to start buying Urea again. A new tender announced by RCF (Rashtriya Chemicals and Fertilizers) on 1st October for shipment by mid-November is understood to close this coming Friday. The pause in the regular tender awards in September should have given Chinese producers the chance to complete earlier contracts and so are they are expected to feature strongly again especially as Egyptian producers didn’t wait and made sales for October during the recent lull. Prices in key producing areas in both the US and North Africa increased between $5-10 in reaction to this news which will be welcomed by the manufacturers. UK market levels are likely to stabilise and then firm as stores around the key ports are mainly well stocked, tonnage commitment from growers is generally behind where it would usually be for the time of year, so with stores pretty full, shippers have had to delay further shipments or change forward purchasing plans. With key Egyptian producers now sold until November the time for markets here to change direction in a lower aspect to any significance is getting shorter and shorter. This view is supported by Northern European markets being in a similar position in terms of volumes confirmed and so they are expected to have to return to the market soon, and we shouldn’t forget Brazil, which may be prompted to make purchases soon as a firmer outlook develops.

Ammonium Nitrate

CF surprised many with an unexpected withdrawal of N and NS prices on 1st October, as things currently stand, they are still out of the market. Speculation in the trade was focused on increased gas prices and more significantly potential changes or removal of gas transmission discounts for large industrial users. There have also been rumours of production issues as CF have not offered any NPK grades since early September. Yara, however continue with a full and positive offer for October and November.

Phosphates

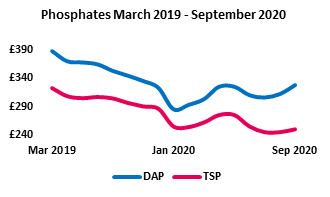

After many weeks and months of weaker Phosphate prices, the market appears to have turned a corner with prices from key US producers firmer last week. Over supply and low demand in late 2019 and 2020 was replaced by production cutbacks and stronger demand in Q4 2020. Further increases are expected so consider covering any P requirements even for spring application.

Economic Data as at close on Friday 2nd October v (25th September 2020) £ = $1.2938 ($ 1.2745) £ = € 1.1044 (€ 1.0956) Crude Oil = $ 39.86 ($ 41.73) Natural Gas = $2.51 ($2.14) Please treat pricing on graphs as a guide, please use quote request form for an up to date price.