Wheat Flags

Influence on wheat prices

28/02/2020

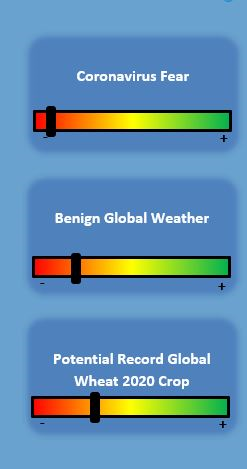

Markets are being rocked by an aggressive sell off triggered by fear that we are heading for a global Coronavirus pandemic.

The virus, which began in China has rapidly spread across the globe at a rate that has alarmed governments the world over. Also, for the first time this week there were more fresh cases from outside of China than inside. This week has been seen as a critical turning point whereby the virus has swung from a relatively contained epidemic in Asia to a global challenge that could, if not controlled successfully, have a far reaching and significant impact on global demand and economies.

As such, markets have plunged lower as traders looks for safe havens and take risk out of their books. Brent Crude Oil for example has fallen from $57.86 on Monday 24th to $49.38 (a fall of nearly 15%) as at the time of writing. Ag commodities have fared little better with Chicago SRW wheat falling circa 5.5% on the week. London futures have also fallen despite the tight new crop S&D for wheat. This is due to the fact that we are already at import parity and so UK markets will move in line with global prices.

Although the reaction seems severe, it’s the uncertainty that the virus brings with it that has really knocked markets. Despite much of the recent trade being a knee jerk reaction to Coronavirus related news it’s impossible to know when the market will look back to fundamentals for trade direction.

In the UK, the much talked about spring plantings remain extremely important to 20 crop hopes. However, continued wet weather already looks sent to disrupt planting intentions. Current estimates from the AHDB show just how uncertain the trade is about crop potential as their current estimate for the wheat crop ranges from 9.01Mmt to 12.63mmt.

Regardless of the spring plantings, imported commodities will play a key part the new crop pricing. At current levels imports already work for the UK and will undoubtably limit price potential going forward. As such, fluctuations in Sterling will also play a role in the forward pricing matrix as Brexit negotiations cause volatility in the pounds value as they have done this week with GBP/EUR moving from 1.1950 to circa 1.1626 at the time of writing.

Globally, weather patterns remain benign and fundamentally little has changed for agri-commodities with strong global supply. The International Grains Council put the 20/21 world wheat crop at a new record 769 Mmt (763 Mmt in 19/20). Next week looks like it will be much of the same and so it will depend of further virus related developments to dictate price movements.